Published

1 year agoon

By

Jack

Navigating the labyrinth of tax implications when selling mineral rights in Texas can seem daunting. This intricate process not only requires a deep understanding of the law but also a strategic approach to minimize financial impact. This guide aims to demystify the complexities surrounding the sale of mineral rights in the Lone Star State, providing a comprehensive overview that serves as a beacon for those embarking on this financial journey.

Table of Contents

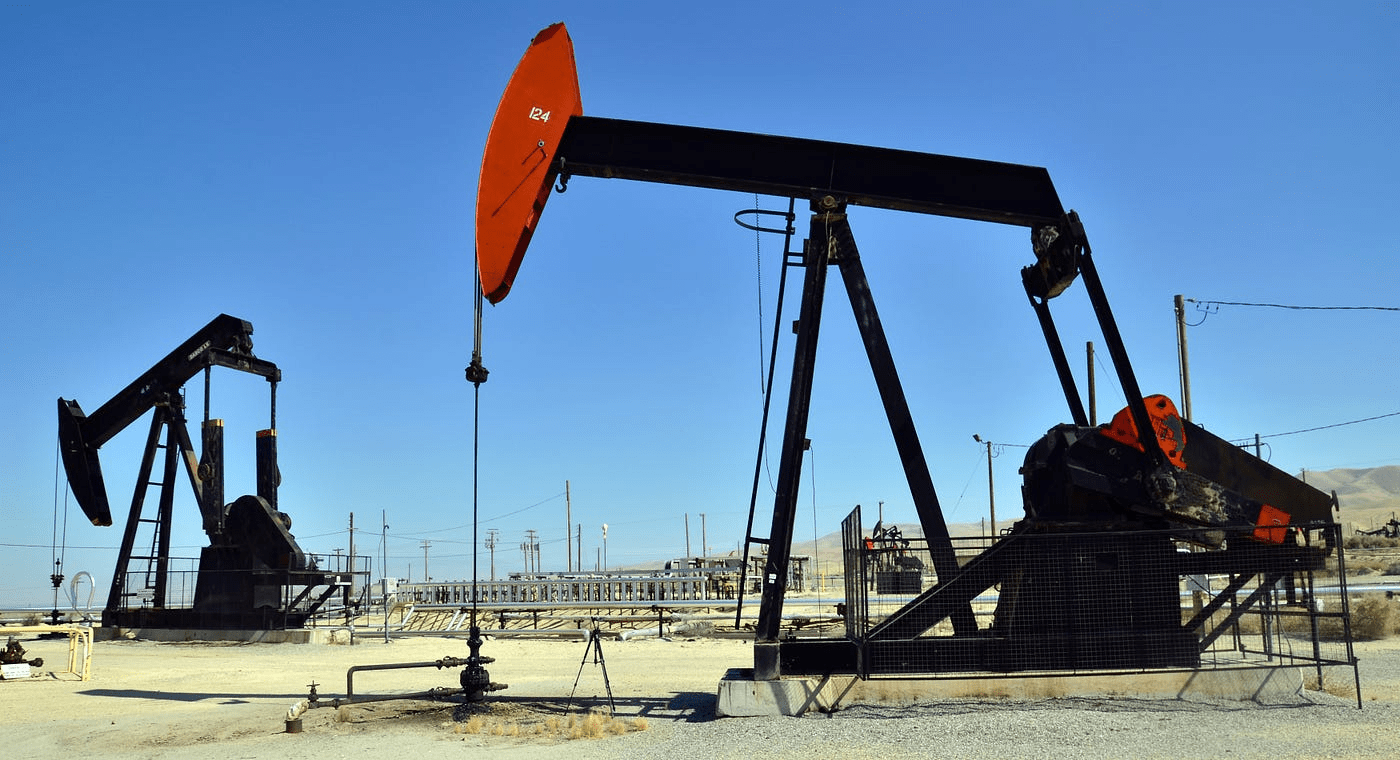

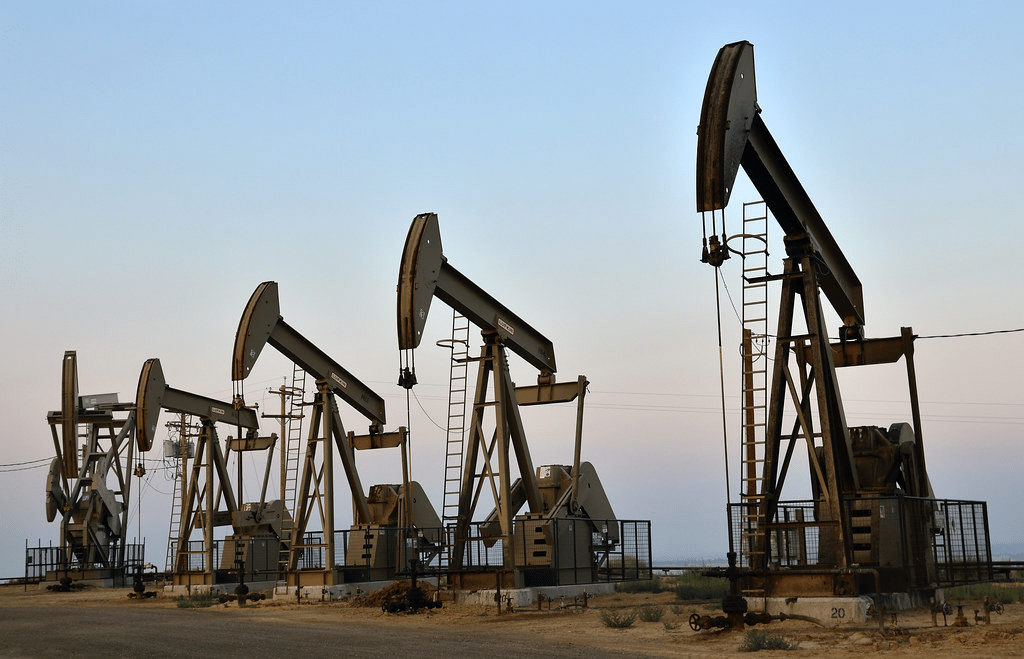

ToggleMineral rights in Texas confer ownership of the natural resources lying beneath the surface. This distinction is crucial in a state where the wealth of the land often lies not in its rolling vistas but in the untapped potential beneath.

In Texas, the ownership and leasing of mineral rights are governed by both state law and contractual agreements. This dual layer of governance allows for a flexible yet complex framework for managing these valuable assets.

Selling mineral rights in Texas involves several steps, crucial for ensuring a smooth transaction. These include:

The sale of mineral rights triggers both federal and state tax considerations, each with its own set of rules and potential pitfalls.

The Internal Revenue Service (IRS) views the sale of mineral rights as a capital transaction, subject to specific tax rates and regulations. Key aspects include:

Texas imposes its own tax structure on the sale of mineral rights, which can include:

Sellers in Texas may be eligible for certain tax exemptions or deductions, potentially reducing their overall tax liability. These can include:

Calculating taxes on the sale of mineral rights requires a thorough understanding of both the sale’s proceeds and the tax laws that apply. Components of this calculation include:

Accurate tax reporting necessitates a comprehensive set of documents, including:

This provision allows sellers to defer capital gains taxes by reinvesting proceeds into similar properties.

Incorporating mineral rights into estate planning can offer tax advantages, potentially shielding assets from hefty taxes.

Sellers can fall into numerous traps, jeopardizing their financial outcome. Common pitfalls include:

Real-world scenarios provide valuable lessons on managing the tax implications of mineral rights sales, from successful tax minimization strategies to cautionary tales of costly oversights.

Examining instances where sellers have effectively reduced their tax liability can offer actionable insights for others.

Conversely, understanding where others have erred can prevent similar missteps.

Addressing common queries can clarify the often opaque process of selling mineral rights and navigating its tax implications.

Given the complexity of tax laws and the high stakes involved, consulting with a tax professional is advisable. Reasons to seek expert guidance include:

Understanding the tax implications of selling mineral rights in Texas is crucial for any seller wishing to navigate this process effectively. By adhering to the guidelines outlined in this comprehensive guide, sellers can make informed decisions, avoid common pitfalls, and potentially minimize their tax liability, thereby ensuring a more favorable financial outcome. In the dynamic and complex landscape of mineral rights sales, knowledge and preparation are key to success.